In this article, we explore how personal loans and financial wellness can work together, addressing common questions and providing actionable insights to help you make informed decisions.

No. 1

What Are Personal Loans?

A personal loan is a type of unsecured loan that can be used for a variety of purposes, such as debt consolidation, home improvements, medical expenses, or large purchases.

Unlike secured loans, such as mortgages or auto loans, personal loans do not require collateral. Instead, lenders approve or deny personal loan applications based on the borrower's credit history, income, and overall financial situation. Many lenders offer the option to get pre-qualified for a personal loan, allowing borrowers to preview potential loan terms before formally applying.

No. 2

How Personal Loans Can Help

Finding effective strategies to tackle high-interest debt and regain control of your finances is crucial for achieving long-term stability and peace of mind.

High-interest debt, such as credit card balances, can be a significant obstacle to financial wellness. The compounding interest charges can make it challenging to pay off the principal balance, leading to a never-ending cycle of debt that can have a detrimental impact on your overall financial health and well-being.

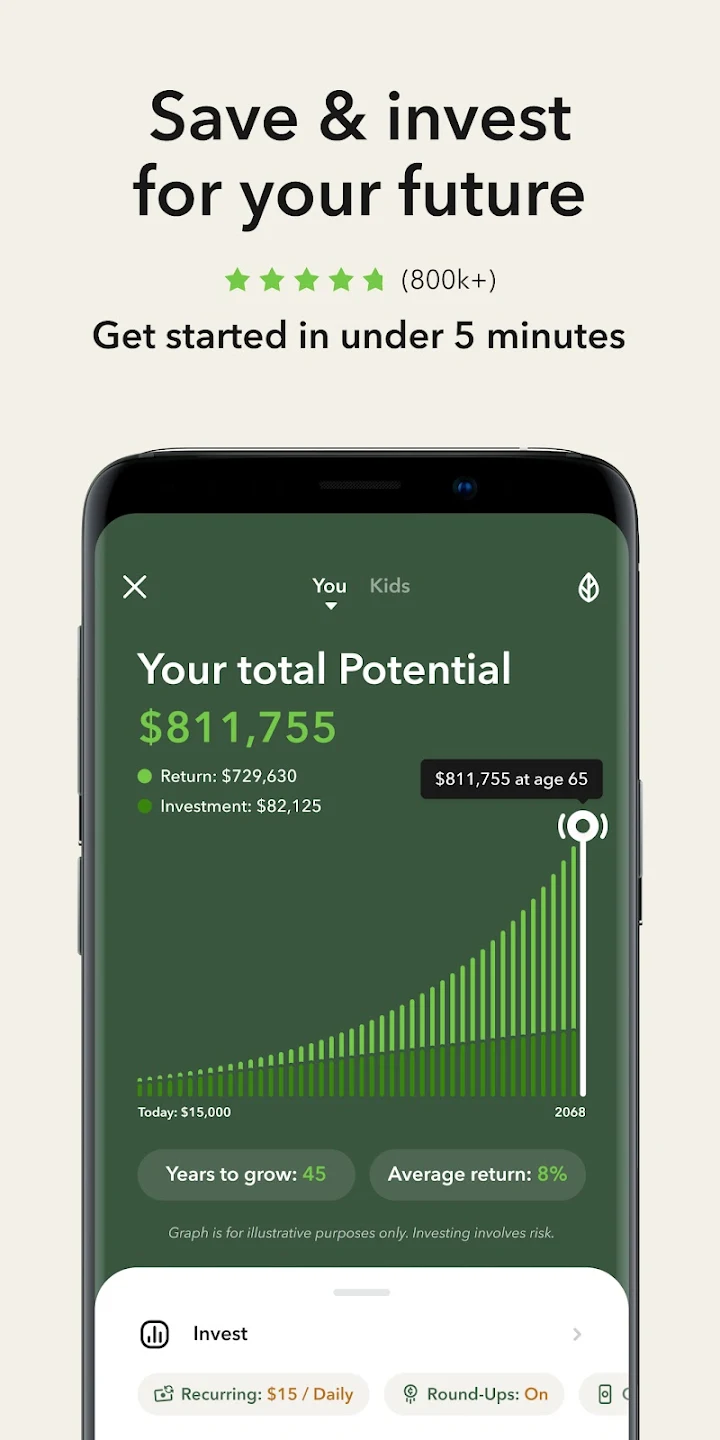

Personal loans can be a valuable tool for debt consolidation, enabling individuals to merge several high-interest debts into a solitary loan with a reduced interest rate. By doing so, borrowers can markedly decrease the total amount of interest paid and streamline the repayment journey, making it more manageable and structured.

No. 3

Benefits of Personal Loans

Personal loans can provide potential benefits for individuals seeking to break free from high-interest debt.

If you are struggling with high-interest credit card debt, a personal loan can offer a more manageable and structured way to pay off what you owe, ultimately helping you achieve financial freedom and peace of mind.

Personal loans offer several advantages that can contribute to financial wellness:

Debt Consolidation: By consolidating multiple high-interest debts into a single personal loan with a lower interest rate, borrowers can save money on interest charges and simplify their monthly payments.

Flexible Usage: Personal loans can be used for a wide range of purposes, allowing borrowers to address various financial needs or goals.

Fixed Repayment Schedule: Unlike credit cards, personal loans have a fixed repayment schedule, making it easier to budget and plan for repayment.

Potential Credit Score Improvement: Responsibly managing a personal loan by making timely payments can help improve your credit score over time.

No. 4

Building Credit and Financial Wellness with Personal Loans

Personal loans can be a valuable tool for building credit and improving financial wellness.

Your credit score is a crucial factor in determining your financial well-being. A good credit score can open doors to better loan terms, lower interest rates, and more favorable financial opportunities. Personal loans can be a powerful tool for building or improving your credit score by demonstrating responsible borrowing behavior and timely repayment, ultimately contributing to a stronger financial foundation for your future endeavors.

When you make timely payments on a personal loan, it demonstrates your responsible management of credit, ultimately enhancing your credit score gradually. Establishing a positive credit history through loan repayments involves borrowing sensibly and meeting payment obligations diligently. It is crucial to avoid late or skipped payments, as such actions can negatively impact your credit rating, negating any advantages gained from the loan.

Additionally, make it a habit to frequently review your credit reports and scores. Doing so enables you to monitor your advancements in building better credit and overall financial well-being. This proactive approach supports you in tracking your journey and promptly identifying and resolving any discrepancies or concerns that may arise.

No. 5

Integrating Personal Loans into Your Financial Wellness Plan

Evaluate Your Financial Situation

Before considering applying for a personal loan, it's crucial to thoroughly assess your complete financial standing. This involves carefully reviewing your income, expenses, outstanding debts, and existing savings. By conducting this comprehensive evaluation, you can make an informed decision about the need for a personal loan and accurately ascertain the amount that aligns with your financial capabilities.

Set Clear Financial Goals

Personal loans can serve as a significant asset when utilized to accomplish targeted financial objectives. These objectives encompass debt consolidation, enhancing your home, covering education costs, or launching a business venture. Establishing well-defined goals is essential in ascertaining the precise loan amount required and formulating a repayment strategy that is in harmony with your overall financial well-being goals.

Compare Loan Options and Terms

Once you've identified your financial goals and the loan amount needed, it's time to thoroughly compare loan options and terms available in the market. Take the necessary steps to research and evaluate different lenders, examining diverse interest rates, fees, and repayment periods offered. Your final decision should prioritize selecting a loan that not only meets your immediate needs but also aligns with your long-term financial goals and overall wellness plan.

Create a Repayment Strategy

Before taking out a personal loan, it is crucial to develop a realistic repayment strategy that aligns with your financial circumstances. Take into account your income, expenses, and any existing financial commitments to accurately assess a reasonable monthly payment. Setting up automated loan payments can be a beneficial way to stay on track with repayments, enhance your credit score, and maintain financial stability.

Monitor Your Progress

Regularly review your progress toward achieving your financial goals and staying on track with your loan repayment. It is essential to consistently monitor your financial status and make necessary adjustments to your budget and spending habits to ensure continued financial well-being while managing the repayment of your loan.

Develop a Debt Consolidation Plan

To effectively use a personal loan for debt consolidation, it's crucial to develop a comprehensive plan. Start by listing all your outstanding debts, including the interest rates, minimum payments, and remaining balances. Then, calculate the total loan amount needed to consolidate these debts, ensuring that it covers all your existing obligations while also considering any additional fees or charges that may arise during the process.

Next, take the time to thoroughly research various personal loan options available in the market. Compare not only the terms, interest rates, and fees associated with each option but also consider any additional benefits or drawbacks they may offer. Once you have identified a favorable personal loan that aligns with your financial goals, proceed to utilize the acquired funds to settle all your existing debts in their entirety. This strategic approach can help streamline your financial obligations and pave the way for a more stable and manageable financial future.

After consolidating your debts with a personal loan, it's essential to stick to the repayment plan diligently. Avoid accumulating new debts at all costs and maintain your focus on consistently making timely loan payments without fail. It might be beneficial to consider automating your payments or setting up reminders to ensure you never miss a payment date and stay on track with your financial goals.

By taking these steps, you can create a solid foundation for your debt consolidation journey and work towards achieving financial freedom.

No. 6

Personal Loans for Home Improvements

If you are looking to renovate your living space or make necessary home improvements but are lacking the funds to do so, a personal loan can be a viable solution.

Enhancing your living space can greatly enhance both your comfort and the overall value of your home. However, securing the necessary funding for these enhancements may pose a challenge, especially in the face of low savings or limited financing options. Personal loans present a viable solution to make these projects financially attainable.

These loans can be utilized to cover a wide range of home improvements, such as renovating your kitchen or bathroom, implementing energy-efficient upgrades throughout your home, enhancing your outdoor spaces, or even adding new rooms. Prior to applying for a personal loan, it is crucial to meticulously plan and budget for your home improvement endeavor to ensure its success.

Obtain quotes from reputable contractors to guarantee that you have a dependable team handling your project. Following that, carefully compile a comprehensive cost breakdown that encompasses every aspect of the tasks at hand. It's crucial to allocate additional funds for any unexpected expenses that might surface throughout the course of the project.

Once you have calculated the total cost of the project, take the time to explore various personal loan options available to you. Look for a loan and payment plan that aligns with your budget and financial goals, ensuring a smooth and stress-free financing process for your home improvement project.

Consider reaching out to financial advisors or loan officers who can provide personalized guidance tailored to your specific needs and circumstances. Making an informed decision when choosing a loan will not only ease the financial burden but also contribute to a successful and rewarding home renovation experience.

Takeaways

Personal loans can be a valuable resource in achieving financial wellness when used responsibly and with a clear plan. By addressing common concerns, setting clear goals, and developing a comprehensive plan, you can leverage personal loans to consolidate debt, finance home improvements, build credit, and achieve greater financial stability. By integrating personal loans into a comprehensive financial wellness strategy, you can take control of your finances and pave the way toward a more secure and prosperous future.

FAQ

How do personal loans affect my credit score?

Personal loans can positively impact your credit score if you make timely payments. However, missed or late payments can negatively affect your credit score. Additionally, applying for multiple loans in a short period can temporarily lower your score.

Can I use a personal loan for any purpose?

Most personal loans are versatile and can be used for various purposes, such as debt consolidation, home improvements, medical expenses, or large purchases. However, some lenders may have restrictions on how the loan can be used.

What happens if I can't make a personal loan payment?

If you're unable to make a payment on your loan, it's important to communicate with your lender as soon as possible. They may be willing to work with you on a revised repayment plan or offer hardship assistance. Late or missed payments can negatively impact your credit score and may result in additional fees or penalties.

How do I determine the right personal loan amount for my needs?

To determine the right personal loan amount, carefully evaluate your financial situation, including your income, expenses, and existing debts. Consider the purpose of the loan and the total cost of the project or expense you're financing. It's generally advisable to borrow only what you need and can comfortably repay within the loan term.

Looking For Home Resources?

Are you looking to enhance your living space and create a sanctuary that supports your well-being? Explore our home partners who offer a wide range of resources to elevate your home environment. From innovative cleaning solutions to interior and exterior additions to creating a mindful living space, our partners are here to support you on your journey toward a harmonious and nurturing home.