A Guide to Managing Your Finances Effectively

Managing your finances effectively is crucial for achieving financial stability and security in the present and future. Implementing the right strategies and habits is essential in taking control of your money and working towards your financial goals. By becoming money-conscious and staying in control of your finances, you can live debt-free and pass on good financial habits to your family and children.

However, financial planning is a thought that can bring a lot of anxiety to most of us. Money often brings anxiety due to the societal pressures and expectations surrounding it. From the need to meet financial obligations and provide for oneself and loved ones to the desire for material possessions and status symbols of success—money plays a significant role in our daily lives.

The fear of not having enough money, the stress of managing finances effectively, and the constant comparison to others' financial situations can all contribute to feelings of anxiety and insecurity. Additionally, financial instability, unexpected expenses, and the uncertainty of the future can further exacerbate these worries.

In a world where financial success is often equated with personal worth, it is no wonder that money continues to be a common source of anxiety for many individuals. If you are struggling to manage your money effectively and it is having an impact on your health and happiness, in this guide we share tips that you can start to implement to get you on the path toward a healthier financial future.

No. 1

Create a Budget

Create a detailed budget that outlines your income and expenses. Be sure to include all sources of income and categorize your expenses to understand where your money is going.

Creating a budget is a foundational step toward achieving financial stability and security. By outlining your income and expenses, you gain clarity and control over your financial situation.

Here are some key benefits of establishing a budget:

Financial Awareness - A budget helps you understand where your money is coming from and where it is going. This awareness enables you to make informed decisions about your spending habits.

Goal Setting - With a budget in place, you can set specific financial goals such as saving for a house, vacation, or retirement. Tracking your progress within the budget allows you to stay focused and motivated toward reaching these goals.

Debt Management - A budget helps you allocate funds towards paying off debts systematically. By prioritizing debt repayment within your budget, you can work towards becoming debt-free faster.

Emergency Fund - Building an emergency fund is crucial for unexpected expenses. A budget allows you to allocate a portion of your income towards this fund, providing a financial safety net for unforeseen circumstances.

Reduced Stress - Knowing where your money is going and having a plan in place can significantly reduce financial stress. A budget empowers you to take control of your finances and feel more confident about your financial future.

Creating a budget is a powerful tool that can positively impact your financial well-being by promoting awareness, goal setting, debt management, emergency preparedness, and overall peace of mind. Starting a budget today will pave the way for a more secure and prosperous future.

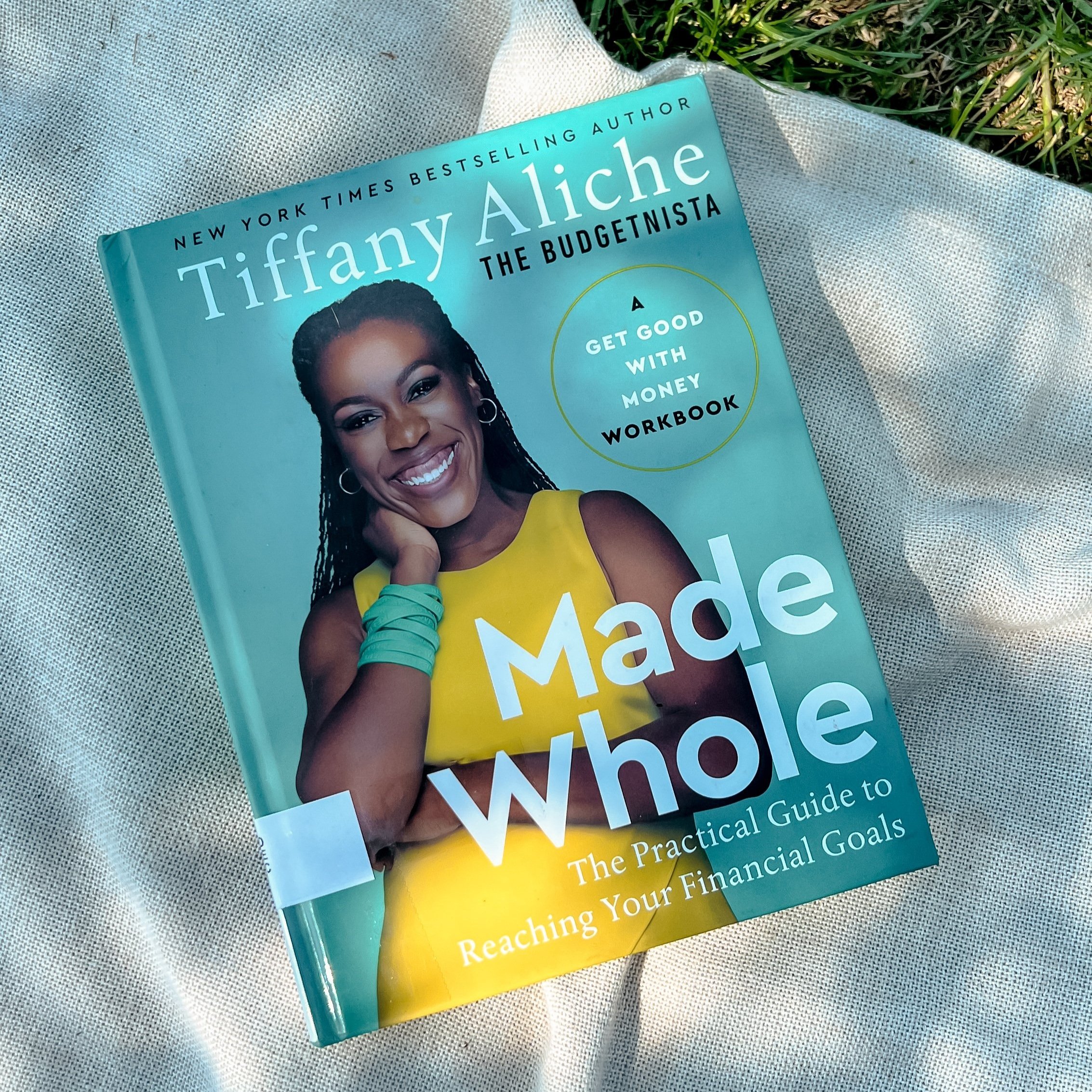

A good place to start on your financial planning journey is to read Made Whole by Tiffany Aliche for an in-depth guide on how to budget and reach your financial goals.

No. 2

Track Your Spending

Keep track of your expenses regularly to see if you are sticking to your budget. This will help you identify areas where you may be overspending and where you can cut back.

Tracking your spending using a spreadsheet is a powerful way to gain insight into your financial habits and make informed decisions about budgeting and saving. By recording every expense in detail, you can clearly see where your money is going each month.

Categorizing expenses allows you to identify areas where you may be overspending and make adjustments accordingly. With the ability to track trends over time, you can set realistic financial goals and track your progress toward them. A well-maintained spending spreadsheet can serve as a valuable tool in taking control of your finances and working towards financial freedom.

Another practical yet effective way to stay on top of your spending is to utilize the tried and true method of checkbooks. Yes—many people still swear by it. By recording each expense and categorizing it accordingly, you gain valuable insights into your spending habits and can make informed decisions to manage your money better.

Using a checkbook allows you to monitor your account balance regularly and more intentionally, helping you avoid overdraft fees and ensuring you stay within your budget. Make it a habit to update your checkbook regularly and review your expenses to maintain financial awareness and control. You may even want to look around for personal checkbook covers to enhance the experience with different styles and colors.

No. 3

Build an Emergency Fund

Aim to save at least three to six months’ worth of living expenses in an emergency fund. This will provide a financial safety net in case of unexpected expenses or emergencies.

Having an emergency fund is crucial for financial stability and peace of mind. It serves as a safety net during unexpected events such as medical emergencies, car repairs, or sudden job loss. By having a financial cushion, you can avoid going into debt or resorting to high-interest loans in times of crisis.

An emergency fund also provides a sense of security, reducing stress levels and allowing for better decision-making during tough situations. Overall, cultivating an emergency fund is a proactive step toward building resilience and maintaining financial wellness. It should be placed as a top priority until you have it checked off.

If you are looking for an automated way to save, Save When I Get Paid and Round Ups is a feature from Chime that makes saving easier so that money is automatically transferred to your savings account. Build your emergency fund on auto-pilot. Earn $100 when you join Chime and receive a qualifying direct deposit.

Chime

Earn $100 when you join Chime plus no monthly fees, get paid 2 days early, get up to $500 of your pay before payday, and fee-free overdraft

No. 4

Pay Off High-Interest Debt

Prioritize paying off high-interest debt, such as credit card debt, as quickly as possible. High interest rates can make it harder to get out of debt, so focus on paying off these balances first.

High-interest debt can be a significant burden on your financial well-being and overall quality of life. When you carry debt with high interest rates, a large portion of your monthly payments goes towards paying off the interest rather than the principal amount owed. This can lead to a cycle of debt that is difficult to break free from.

By prioritizing paying off high-interest debt, you can save money on interest payments, free up funds for other expenses or savings, and ultimately regain control over your financial situation. Additionally, reducing your debt ratio can improve your credit scores, making it easier to secure loans or credit cards in the future. Ultimately, by addressing high-interest debt proactively, you can lay a strong foundation for a more secure and prosperous financial future.

If you are looking to improve your credit score, we suggest Capital One’s pre-approval tool. Their tool makes it easy to see what cards you’re eligible for with no impact on your credit score. Plus, no credit score is required to apply. Another option is Money Lion where you can establish a credit history or rebuild your credit with their Credit Builder Plus Membership with a Credit Builder Loan. Build credit while you save — with no hard credit check. Sign up for Moneylion and get up to $60.

No. 5

Save for the Future

Start saving for your future goals, such as retirement and homeownership. Consider setting up automatic contributions to your investment savings accounts to make saving easier.

Many people underestimate the importance of having a savings investment strategy for retirement, homeownership, and other expected long-term needs. Planning for these milestones is crucial for ensuring financial stability and security in the long term.

When it comes to retirement, having a savings investment allows you to build a nest egg that can support you during your non-working years. Whether through employer-sponsored retirement accounts like 401(k)s or individual retirement accounts (IRAs), investing regularly in these accounts can help grow savings over time through compound interest.

Similarly, saving for homeownership is a significant financial goal that requires careful planning and foresight. A savings investment dedicated to buying a home can help cover the down payment, closing costs, and ongoing homeownership expenses.

By considering all of your options, you can feel confident that you are building financial security. The earlier you start, the better you will be. So, it is best to have a plan so that your money can grow over an extended period to see the best capital gains.

No. 6

Invest Wisely

Learn about different investment options and consider investing for long-term growth. Diversifying your investments can help you manage risk and potentially earn higher returns.

Investing offers a multitude of benefits that can significantly impact one's financial well-being and future security. By investing wisely, you have the opportunity to grow your wealth and secure a stable financial future for yourself and your loved ones. It allows you to stay ahead of inflation, where your money retains or increases its value over time.

From learning the best stocks to buy in Canada, to investing in mutual funds and real estate, there are many different types of investments you can make.

Here are several types of investments:

Stock Market - Investing in individual stocks represents ownership in a particular company. This type of investing carries a higher level of risk but can also offer significant returns.

Bonds - Bonds are debt securities issued by governments or corporations. Investors receive fixed interest payments over time and the principal amount back at maturity.

Mutual Funds - Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by a professional fund manager.

Real Estate - Investing in real estate involves purchasing properties with the expectation of generating income through renting, leasing, or selling for a profit.

Cryptocurrency - Cryptocurrencies are digital assets that use blockchain technology for secure transactions. Investing in cryptocurrencies can be highly volatile but has the potential for significant gains. Sign up for Crypto.com and get $25 to start your crypto journey.

Commodities - Investing in commodities involves trading physical goods like gold, oil, or agricultural products. Prices are influenced by supply and demand dynamics as well as global economic conditions.

ETFs (Exchange-Traded Funds) - ETFs are investment funds traded on stock exchanges, holding assets like stocks, commodities, or bonds. They offer diversification and are passively managed.

Retirement Accounts - Investing in retirement accounts like 401(k)s or IRAs provides tax advantages for saving for retirement. These accounts often offer a variety of investment options to help grow your savings over time.

Investing provides a way to achieve long-term financial goals that can seem insurmountable at first. It is a powerful tool that empowers individuals to take control of their financial futures and work towards a more prosperous life. If you are looking for a place to start investing, Acorns makes it easy to save and invest.

No. 7

Review and Adjust Your Finances Regularly

Regularly review your budget, savings, and investments to ensure you are on track to meet your financial goals. Make adjustments as needed to stay aligned with your objectives.

Tracking your finances regularly is crucial for several reasons. Firstly, it helps you gain a clear understanding of your spending habits and financial situation. By carefully monitoring your income and expenses, you can identify areas where you may be overspending and make necessary adjustments to stay within budget.

Regularly tracking your finances also allows you to set and achieve financial goals. Whether you are saving for a big purchase, building an emergency fund, or planning for retirement, keeping a close eye on your finances enables you to track your progress and make informed decisions to reach your goals faster.

Additionally, monitoring your finances regularly helps you avoid unnecessary debt and keep track of any irregularities or potential fraudulent activities. By reviewing your accounts and transactions frequently, you can quickly spot any discrepancies and take action to address them promptly.

Overall, the benefits of tracking your finances regularly include improved financial awareness, better money management, progress toward financial goals, and increased financial security. Make it a habit to track your finances consistently to take control of your financial future.

Takeaways

By following these tips and staying proactive in managing your finances, you can build a strong financial foundation and work towards a more secure financial future. Remember, small changes in your financial habits can lead to significant improvements over a short period of time. Start taking control of your finances today, and reap future rewards. The price you pay now for financial discipline is priceless in comparison to the peace of mind and financial freedom you will gain.